MindSumo allows students to solve real-world projects from the world’s largest companies. Propose the next big idea and gain experience for job opportunities.

Applying for a scholarship? Check out our scholarship essays database>

Applying for a scholarship? Check out our scholarship essays database>

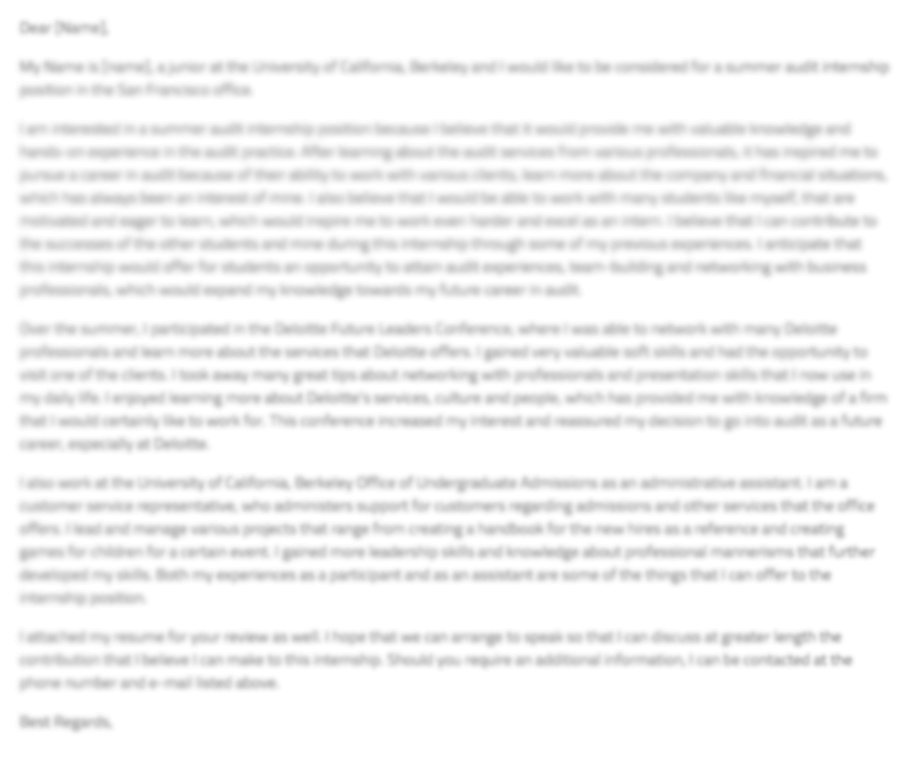

Sample cover letter for Full Time position at Dalberg

POSITION:

Analyst

Enter your email to access all cover letters.

We will not spam or share your email.

Get access to over 7,000 cover letters from candidates getting jobs at your target companies.

Fact: Google is more likely to hire you if your resume includes side projects. Explore company projects on MindSumo